On August 24th, President Biden announced his plan for student debt forgiveness. As the White House has been suggesting for many months, Biden opted to cancel $10,000 in student debt for debtors who make under $125,000 a year. He granted an additional 10k in forgiveness to students and former students with Pell Grants, and extended the payment pause through the end of the year.

For the majority of Americans who attend college, student loan debt is an inevitable reality. As of 2022, students have borrowed a staggering $1.75 trillion, with the average student owing roughly $36,520 in student loan debt — if not more. In fact, attaining a bachelor’s degree leaves most students with an average of $32,000 worth of crushing debt.

With this in mind, we’re exploring just how this new debt forgiveness plan will reshape the lives of borrowers — and help reshape the country’s financial landscape, too. Will the President’s plan be enough to significantly impact the lives of those burdened by debt? Will it live up to the goal of advancing racial equity?

What Is President Biden’s Plan for Tackling Student Loan Debt?

Biden announced a three part plan for tackling student loan debt:

- Provide targeted debt relief. Biden’s plan to cancel 10k of student debt for borrowers who make less than 125k/year and 20k for students with Pell Grants is designed to make sure that lower- and middle-income borrowers reap the benefits of debt cancellation.

- Make loan repayment more manageable. Biden’s plan includes changes to repayment policies, allowing students with undergraduate loans to cap their payments at 5% of their monthly income (down from 10%).

- Protect future students. Biden has committed to fighting to increase the availability of Pell Grants, assuring that government aid increases with the cost of college.

While some lawmakers, like Senator Warren and Senator Chuck Schumer (Dem-NY), have pressured the president to forgive up to $50,000 in federal loans by executive order, Biden made it clear that he considered such a steep cancellation to be a potential abuse of his executive powers. Instead, it seems he’s taken a slightly more conservative approach,even though “56% of [Americans surveyed] said they support federal student loan forgiveness by executive order” (via Forbes).

Is Student Loan Debt Holding Americans Back?

In 2003, American students borrowed a total of $0.24 trillion from the government. Since that time, the amount has risen meteorically, growing to a whopping $1.73 trillion by 2021. That growth rate exceeds 23.6% — the previous annual growth rate in 2020. Over the past 50 years, wages have increased by 67%, but college tuition fees have increased at much higher rates. For example, since the 1980s, students’ tuition fees for undergraduate degrees from public institutions grew by a staggering 213%.

“Student loan debt is holding back a whole generation from buying homes, starting small businesses, and saving for retirement — all things we rely on to grow our economy,” Senator Elizabeth Warren (D-Mass.) tweeted in November 2020. “Executive action to #CancelStudentDebt would be a huge economic stimulus during and after this [COVID-19 health] crisis.” Warren has been a longtime supporter of canceling student loan debt and her plan to do so was a cornerstone of her bid for the Democratic presidential nomination. And Senator Warren is right: Folks who are drowning in debt aren’t spending money, starting families, or investing in their futures.

A huge contributing factor? Students loans are amortized, which means, for most folks, all those monthly payments are whittling away at the interest while the “underlying loan continues to rack up new interest charges every day” (via SoFi Learn). For many, this creates a feeling of helplessness: Money is stretched thin to cover these monthly payments, but the balance due continues to climb higher. Needless to say, most grads simply aren’t making enough to cover their monthly student loan payments. In fact, almost 50% of millennials believe that their college experience wasn’t helpful enough in advancing their careers to a point where paying off that accrued debt is possible. To make matters worse, over 3 million folks over the age of 65 are still paying off debt from their college days, meaning many Americans are literally saddled with a lifetime of debt.

For those who have their debt forgiven, applying for mortgages or even considering starting families may suddenly feel possible. But with the average loan amount sitting at about $30,000, the current forgiveness plan may feel more like a drop in the bucket than a life changing moment.

How Will Forgiving Student Loan Debt Help the Economy?

In a Business Insider article released in February 2021, six experts and economists spoke on the benefits of student loan debt forgiveness and broke down the opportunities such a policy could create. As of 2020, more than 10.7 million Americans faced unemployment, all while contending with their student loan debt. The largest number of borrowers owe between $20,000 and $40,000, and experts believe that erasing even $10,000 of debt per person would make it easier for folks to repay the rest of their debt.

This subject was also debated on Twitter by Bharat Ramamurti, the Deputy Director of the National Economic Council (NEC) for President Biden, who compiled a lot of insight into why forgiving student loans in totality would be extremely beneficial for the American economic crisis. Ramamurti concluded that it could have a stimulating effect on the economy and create job growth. The Levy Economics Institute of Bard College supports these viewpoints, finding that canceling student debt — all of it — would bring anywhere from $86 to $108 billion of gross domestic product (GDP) annually.

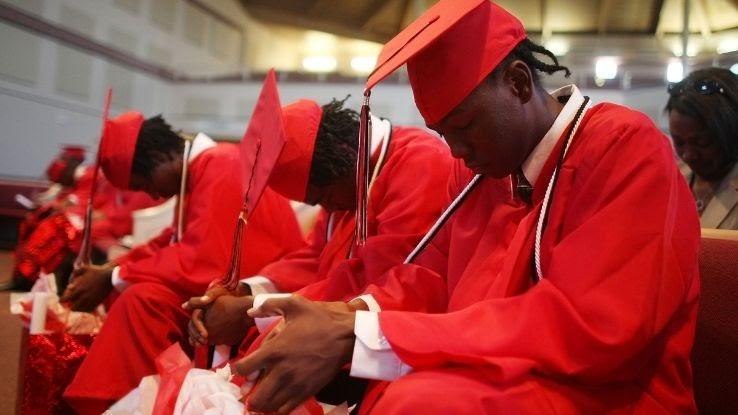

How Can Cancelling Student Loan Debt Narrow the Racial Wealth Gap?

Student loan debt also disproportionately impacts Black students. According to a 2018 study, Black students held as much as 85.8% more debt than white students. Additionally, a high-profile study from the Brookings Institute in 2016 found that “on average, Black students owed $7,400 more than white, Asian and Latinx students upon graduation” (via Saving for College). Critics of Biden’s plan point out that Black borrowers, who carry greater loan balances, will now be left behind to keep paying off their debt as their white peers can begin to direct that money towards things like buying homes.

Furthermore, racial inequalities follow Black students long after they have graduated: Black Americans face systemic barriers that keep them from attaining high-paying jobs — jobs that would actually help them make headway on paying down student loan debt. The Center for American Progress also notes that, due to the ever-widening racial wealth gap, Black Americans are at a disadvantage compared to white Americans when it comes to saving for college; this inequality not only impacts Black families, but goes on to impact Black students and, in the end, saddle them with even more student loan debt. Needless to say, forgiving student loan debt might be just one step in erasing the systemic barriers Black folks face in America, but it’s certainly an integral one.

How Does Student Loan Debt Impact a Borrower’s Mental Health?

If these truths weren’t enough to shoulder, student loan debt is also much more than just the root of financial strain. A study conducted by Student Loan Planner in May 2021 unearthed some distressing truths when it comes to the link between student loan debt and borrowers’ mental health. For one, 53% of high-debt borrowers have experienced depression as a direct result of that debt, while 9 in 10 borrowers experience loan-related anxiety. Additionally, the survey data “suggested that 1 in 11 deaths by suicide among young professionals were partly due to student loans.”

Melanie Lockert, who attended California State University, Long Beach as an undergraduate and got her master’s degree from New York University, found herself saddled with $81,000 of student loan debt. In an interview with CNBC Select, Lockert said, “I had this whole trajectory. I got into my dream school, NYU, then to be making $10-12 an hour and not working in your field, it felt so depressing and I felt so much shame for going to a fancy private school. …I was severely depressed and anxious.”

Of course, the experiences of anxiety and depression are never cordoned off — instead, these experiences snowball and seep into other areas of one’s life. That is, not having the ability to pay back loans means borrowers are putting off traditional life milestones — expenses like buying a house or starting a family — and, in turn, leaving these ambitions unfulfilled can further impact one’s mental health. With the costs of mental healthcare and support on the rise — and with financial strain being the root of many of these experiences of anxiety and depression — how are borrowers expected to find treatment and support? It’s clear that the burden of student loan debt isn’t just a burden to folks’ wallets but on their total well-being. Whether or not this forgiveness plan will be enough to improve the mental health of borrowers is yet to be seen.

What’s Next For Americans With Student Debt?

If you have student debt, get in touch with your loan provider to make sure they have up-to-date information about your income. Student loan payments will remain paused through the remainder of the year, partially to give loan providers time to prepare for restarted payments. Keep track of correspondences you receive about your loan balance.

You can also continue to fight for debt cancellation. The Student Debt Crisis Center is continuing to organize and has vowed to keep fighting until all debt has been cancelled. The news of Biden’s forgiveness plan comes on the eve of their 10 year anniversary, and they’ve quickly pivoted away from an anniversary celebration and planned an organizing meeting in its place. Senate Majority Leader Chuck Schumer and Senator Elizabeth Warren along with activists, borrowers, and lawmakers are expected to speak on what the next steps are to address the student debt crisis.